FOR A COMPLIMENTARY CONSULTATION REGARDING YOUR MEDICARE,HEALTHCARE, LIFE INSURANCE OR LTC NEEDS PLEASE CONTACT US BELOW.

Elevation Benefits & Consulting

is an independent full-service employee and executive benefits brokerage and consulting firm with a focus on small to mid-sized companies. For individuals paying for their own coverage, we offer a solution outside of The MarketPlace that is a PPO Plan. In the business arena our focus is on group health, executive benefits, HR and Payroll Outsourcing either independently or thru a PEO or ASO. Benefits can include dental, vision, short and long term disability, life and AD&D and a Universal Benefit account. We provide access to a LTD policy for executives that is above what one can get with group benefits.

We provide business insurance planning in the form of buy/sell agreements, key person life insurance and business valuation assistance. Elevation has the ability to assess your estate taxability to give you the opportunity to plan for estate taxes and admin expenses. We have a tax-free retirement solution for highly compensated individuals ($200K+) who have maxed out their 401K contributions. We offer several solutions to Long Term Care to assist with preservation of assets and family dynamics.

Since Elevation Benefits & Consulting are independent and beholden to no particular carrier, we have the ability to provide what is in the best interest for you and your Company.

The growth of your business and preservation of assets is important to us. You have invested time, energy and money into building what you have today. We are here to help you not only maintain that but retain and attract top talent.

About the Founders

Cindy K Brown and Denise Sander co-founded Elevation Benefits & Consulting by bringing together their diverse corporate backgrounds to benefit their clients. Cindy has 25 + years working on Wall Street in the wealth management, estate planning and business consulting arena with a focus on small to medium sized businesses. She has authored two books, “How to Market Your Business Online” and “How to Create Financial Freedom Through Marketing Your Business”. Cindy has a passion for helping small business to grow as she believes small businesses are what helped make this country great! Navigating thru the options as a business owner she knows how complicated and confusing the information can be. That’s why Elevation Benefits & Consulting provides options for individuals outside of The Market Place in addition to ACA compliant individual and group plans.

Denise Sander has 20+ years in the medical field from clinical environment to medical sales, which included pharma and medical devices. She recently became involved in the outsourcing side of the business, which included group health plans, HR and payroll. Her medical background drives her passion and cost-effective health and supplemental benefit solutions for her clients, enabling them to maximize the best of care with the least out of pocket expense.

Cindy and Denise have pooled their expertise in co-founding Elevation Benefits & Consulting to provide a holistic solution for business owners and individuals regarding not only health benefits, but supplemental benefits that can protect income and assets into retirement.

Did You Know

Cost of Non-Compliance

40.5% of all employment lawsuits are brought against businesses with 100 employees or less

Health and Supplemental

During the past decade, the average health insurance deductible for employer-based coverage climbed more than 150 percent, according to the Peterson-Kaiser Health System Tracker.

On average, single Americans with coverage through their employers had deductibles of $1350 in 2018. That’s compared to $533 in 2009.

Staring In 2020 millennials will make up 50% of the workforce-75.4 million. Millennials rank benefits as #1 for recruitment and retention

Resources You May Find Helpful

Dental/Vision:

Ameritas®️

PrimeStar®️ Total - Is the best value long term, but take a look:

https://myplan.ameritas.com/id/eae71e8a

The provider link is located right under the blue select plan button or you can go to https://dentalnetwork.ameritas.com/

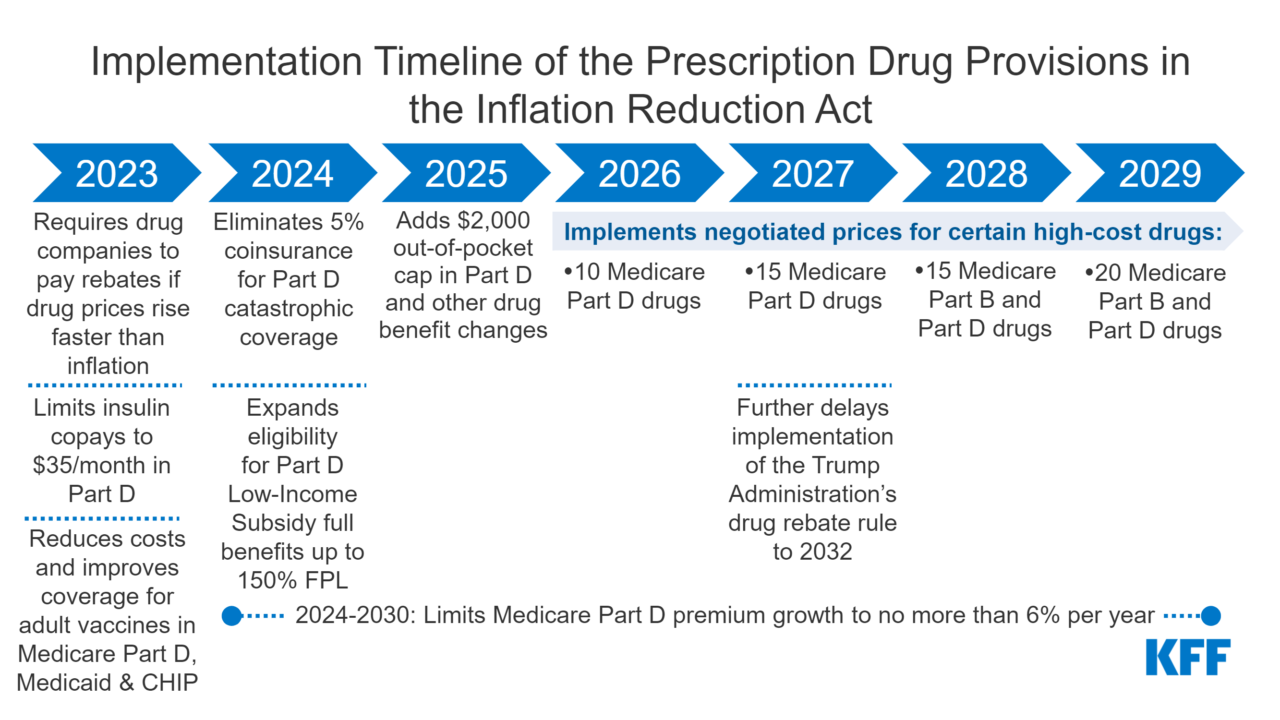

Options for Less Expensive Prescriptions: This is something we have spent a lot of time researching as it can be one of the greatest expenses:

Cost Plus Drugs: https://www.costplusdrugs.com/

IsraelPharm: https://www.israelpharm.com/?raf=ref1567205 use this link and get $50 off your first order

Canadian Pharmacies:

www.Canadapharmacy.com

www.mapleleafmeds.com

www.canadianprescriptiondrugstore.com

Social Security to sign up for Medicare Part A& B or apply for retirement benefits: www.ssa.gov

Medicare: https://www.medicare.gov/

Statistic of Long-term Care (TLC)

70 percent of all Americans who turn 65 will eventually enter a nursing home.

One-half of all nursing home patients are discharged within six months. However, the average length of stay for those who do not leave within six months is four years.

Fifty percent of all long-term care costs are paid out of pocket.

Medicare pays only about 41.5 percent of the annual nursing home costs.

Nearly 60 percent of persons age 65 and over will need long-term care either in a nursing home or in their own home.

For every person in a nursing home, it is estimated that there are at least two others with an equivalent level of disability who are not institutionalized. Approximately, 80 percent of this non-institutional care is provided by family members.

The average annual cost of LTC in Texas in major cities is:

Compare Long-term Care Costs

Texas State Averages:

$62,530

Your Medicare Coverage Choices

Decide how you want to get your coverage

ORIGINAL MEDICARE

Part A

Hospital Insurance

Part B

Medical Insurance

Step 2:

Decide if you need to add prescription and drug coverage

Part D

Prescription Drug Coverage

Step 3:

Decide if you need to add supplemental coverage

Medicare Supplement

Insurance (Medigap)

OR

MEDICARE ADVANTAGE

Part C

HMO / PPO / POS

Combines Part A, Part B, and usually Part D

Step 2:

Decide if you need to add prescription and drug coverage

Part D

Prescription Drug Coverage

(Most Medicare Advantage Plans cover prescription drugs. You may be able to add drug coverage in some plan types if not already included.)

If you answered YES to any of these questions...

CALL US TODAY!

Annual Enrollment Period (AEP) now begins October 15th and ends in December 7th to give you

more time to choose and join a Medicare plan... (Medigap policies can change at any time)